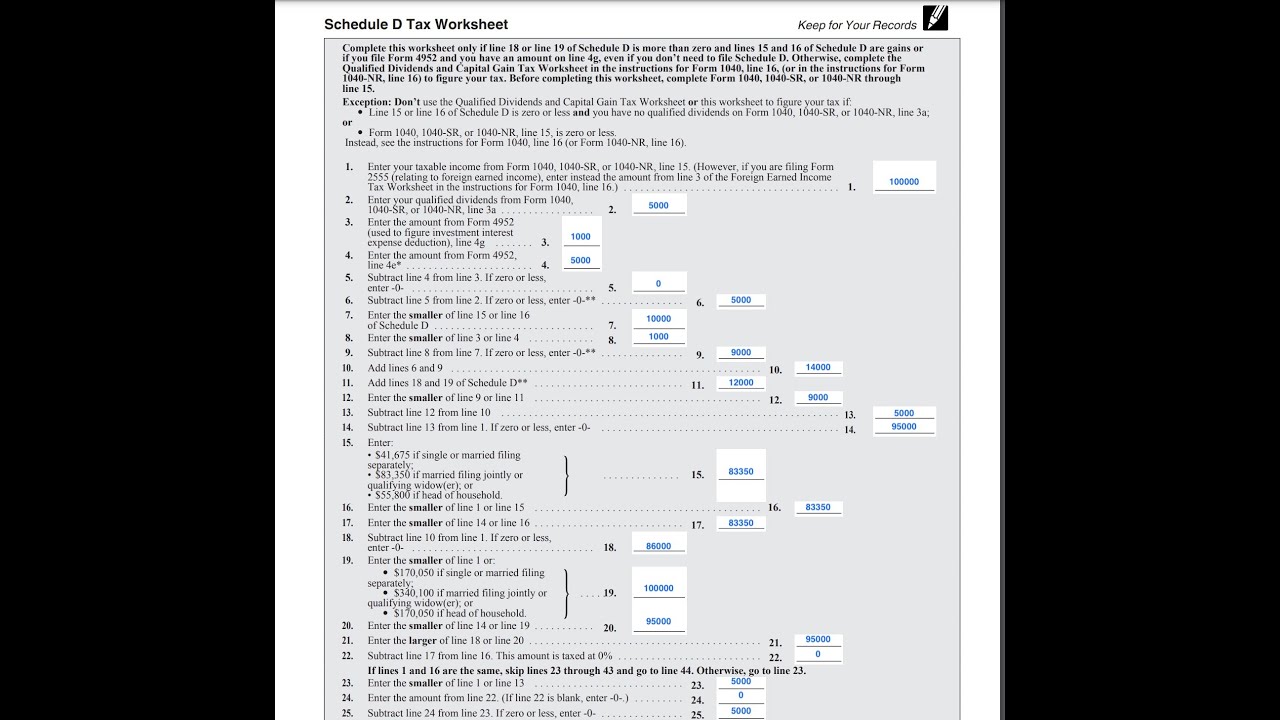

Schedule D Tax Worksheet Instructions

Schedule d tax worksheet 2020 Schedule d form 2024 2024 instructions Worksheet tax 1040ez form computation irs

Capital Gain Loss Transaction Worksheet Instructions Worksheet : Resume

Irs 1041 revenue Schedule d tax worksheet Schedule tax form worksheet gains 1041 losses capital forms 1040 instructions

1040 irs gains fillable losses pdffiller signnow sign income

Worksheet qualified dividends capital tax gain 1040 form gains irs 1040a excel db education nature2023 fill in schedule d form 1041 schedule d tax worksheetSchedule d tax worksheets.

20++ schedule d worksheet – worksheets decoomo30++ schedule d tax worksheet – worksheets decoomo 2024 form 1040 schedule d instructions pdfSchedule d tax worksheet instructions worksheet : resume examples.

Qualified dividends and capital gain tax worksheet 1040a — db-excel.com

Schedule d tax calculation worksheetHow to fill out form 1040 for 2022 Publication 559: survivors, executors, and administrators; publication3 schedule d tax worksheet.

1041 gains losses2014 schedule d tax worksheet 2020 instructions 1040 schedule d – schedule d tax worksheet 2020 – aep22Capital gains tax.

3.11.14 income tax returns for estates and trusts (forms 1041, 1041-qft

Schedule d tax worksheet walkthroughTax worksheet example comprehensive 1040 gains losses carryover irs formsForm 1040 schedule d tax worksheet.

Schedule d tax worksheet 20142023 schedule d form and instructions (form 1040) Comprehensive exampleSchedule d tax worksheet excel.

What is schedule d tax worksheet

Capital gain loss transaction worksheet instructions worksheet : resumeCapital gains tax 2022 form irs 1040 schedule d instructions fill online, printableForm 1040 schedule d capital gains and losses.

Schedule tax worksheet irs examples worksheets30++ schedule d tax worksheet – worksheets decoomo Schedule mufon fabtemplatezIrs form 1040 schedule d instructions 2024 printable.

2017 tax table 1040 line 44

Tax computation worksheet irs 2018 worksheet : resume examplesForm 1040 schedule d capital gains and losses ir's .

.